RCOR delivers expert claim calculations and litigation reports, tailored based on solicitors’ instructions and requirements. As a vital resource for law firms, funders, and ATE insurers, our precise and insightful reports provide the clarity and confidence required to secure successful outcomes.

Precise Calculations & Litigation Report for Fair Outcomes

Services

Litigation Reporting for Success

RCOR’s litigation reports are meticulously crafted based on solicitors’ instructions and case-specific requirements. These high-quality, bespoke reports provide a clear and accurate representation of calculated estimates, aligning with the unique aspects of civil litigation claims. By integrating advanced mathematical algorithms, RCOR ensures unparalleled accuracy, creating a robust foundation for securing favorable resolutions. These reports are also crucial for securing litigation funding and ATE (After the Event) insurance, offering funders and insurers the clarity and reliability needed to make informed decisions, strengthening the claims process and positioning every claim for success.

Services

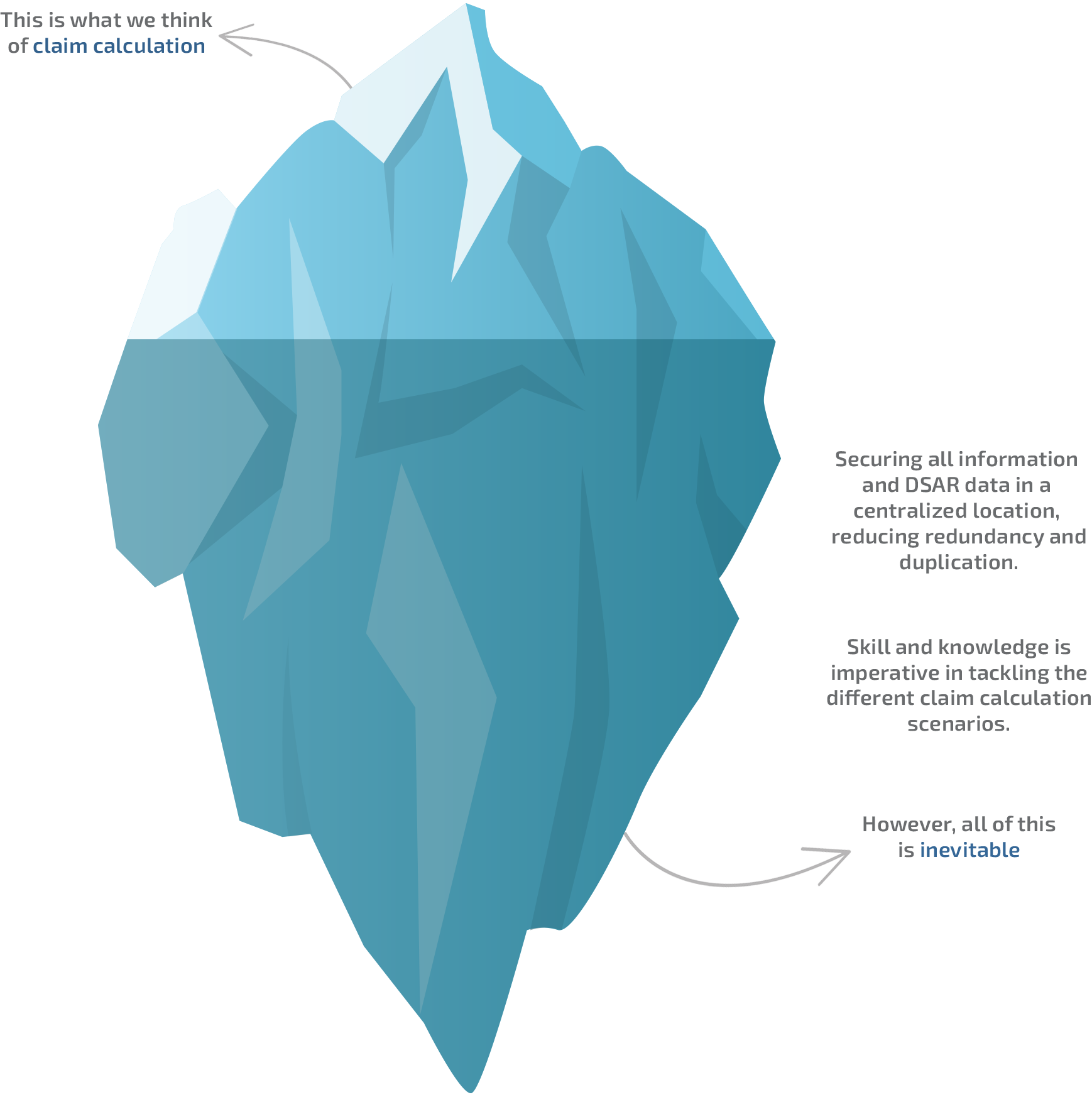

Beyond the Iceberg's Tip in Claim Calculations

Services

Key Factors in Claim Calculations

RCOR’s claim calculation services incorporate various factors to ensure fair and accurate compensation estimates. These are some of the basic factors:

- Interest Rate Discrepancies: Evaluating the difference between the interest rate charged and the one that should have been applied.

- Repayment Duration: Assessing how long the claimant has been repaying the loan to determine the total financial impact.

- Loan Value: Factoring in the size of the loan to calculate overpaid interest accurately.

- Quantum Analysis: Providing detailed insights into overpayments or undisclosed commissions.

- Compensatory or Statutory Interest: Applied wherever it is found that the borrower has made an overpayment, ensuring fair restitution.